You’re tired of the renting game and you’re in a stable job, making good money. It seems like a great time to look at purchasing your own property, right? Before you start collecting an open house list, there are plenty of things you need to consider. Here are four points you need to think about before buying. This post is in collaboration with Templeton Property.

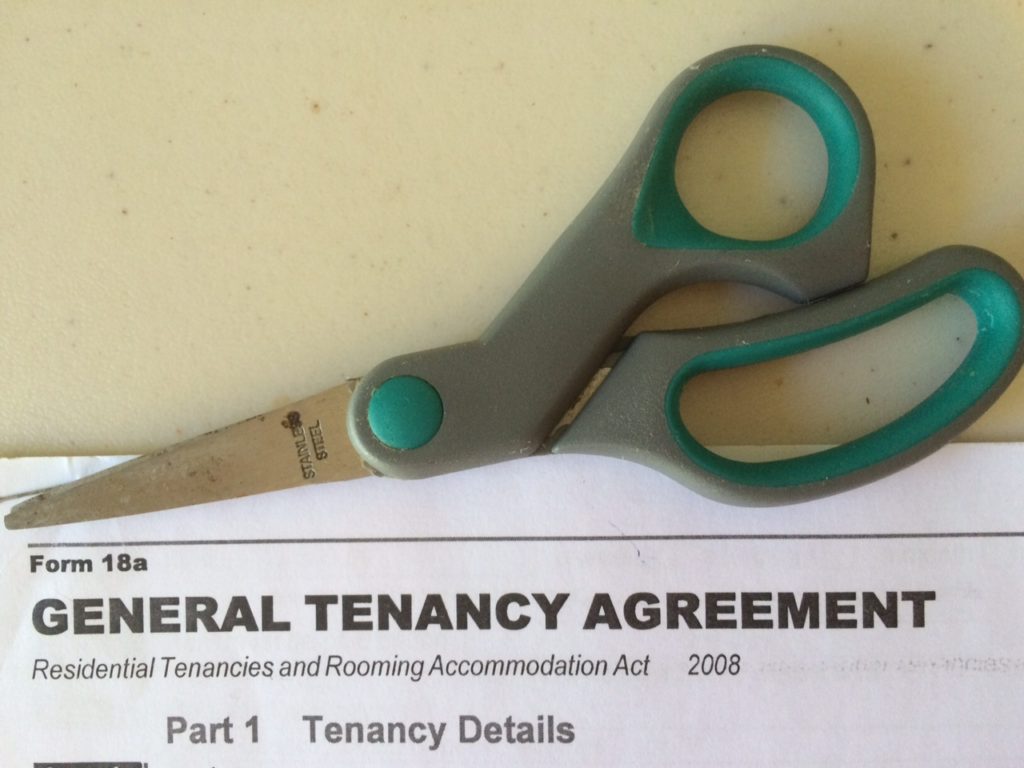

Are you ready to cut these up for good?

1. Are You Financially Ready to Buy Property?

Ask yourself this question first up. Have you saved enough money for a deposit? Most financial institutions will recommend to have at least 20% of the purchase price saved, as well as enough to cover application and conveyancing costs. You will need a good savings history and employment history. If you have these things, preapproval for a loan is the best place to start. You then know how much you can afford to spend on a property.

2. Do You Want to Use a Property Agent?

A good property agent can save you time, stress and money. Decide early if you will do the hunting for a suitable property yourself or leave it to an experienced property agent. A professional property agency takes the time to consult with you on budget, priorities, location and other preferences and then sources suitable properties for you. They can also bid on your behalf at auctions, which can stop you getting excited and bidding over the budget. Hiring a property agency, such as Templeton Property, is often a good idea – especially if you’re looking to buy an investment property. Check out this URL for more information about how a property agent could assist you.

3. What Are Your Property Priorities?

Your priorities are going to have a big impact on the type of houses you view and ultimately make an offer on. For example, if you have children, you will want to be in a location close to good schools. Don’t have time to garden? Bear that in mind when a beautifully manicured yard is tempting you. If you are planning a large family, a small home with a courtyard is not the property for you. Before you even begin viewing properties, it is wise to work out what features you aren’t willing to compromise on.

The area you live in has a big impact on your lifestyle, so choosing a property in the right locale is also an important consideration when buying. Is there future development planned? Are you close enough to work, transport and amenities?

4. Have You Done Your Research?

The property game is an emotional one, whether you are purchasing your first home or investing in a rental property. When you have done your research, you will apply more logic to your decisions. If you are emotionally attached to a property before you even make an offer, you may find yourself overlooking the property’s condition and true value. Letting emotions get the better of you is a fast track to overspending on your budget.

These are four things you need to consider before you get serious about buying a property. Is there anything else you think is crucial to do before you start house hunting? Share your thoughts and tips in the comments below.